All Categories

Featured

Table of Contents

[/image][=video]

[/video]

However the landscape is changing. As passion prices decline, dealt with annuities may shed some charm, while items such as fixed-index annuities and RILAs gain grip. If you remain in the marketplace for an annuity in 2025, store very carefully, compare alternatives from the very best annuity business and prioritize simplicity and openness to find the best fit for you.

When picking an annuity, financial toughness rankings issue, but they do not tell the whole tale. Below's just how contrast based on their ratings: A.M. Ideal: A+ Fitch: A+ Criterion & Poor's: A+ Comdex: A.M. Ideal: A+ Fitch: A+ Moody's: A1 Standard & Poor's: A+ Comdex: A.M. Finest: A+ Moody's: A1 Criterion & Poor's: A+ Comdex: A greater monetary ranking or it just reflects an insurance provider's financial stamina.

A lower-rated insurance provider may provide a, resulting in considerably more income over retirement. If you focus just on ratings, you may The finest annuity isn't almost business ratingsit's around. That's why comparing real annuity is more crucial than simply taking a look at financial strength ratings. There's a great deal of noise around when it concerns monetary suggestions regarding annuities.

That's why it's necessary to obtain advice from someone with experience in the market. is an staffed by independent accredited monetary experts. We have years of experience assisting people locate the best products for their needs. And due to the fact that we're not connected with any kind of business, we can offer you objective suggestions concerning which annuities or insurance coverage are right for you.

We'll assist you sort with all the choices and make the finest decision for your situation.

And bear in mind,. When it involves repaired annuities, there are many choices around. And with numerous selections, knowing which is appropriate for you can be hard. There are some points to look for that can help you tighten down the area. First, opt for a highly-rated firm with a strong reputation.

Pba Annuity Fund

Choose an annuity that is easy to comprehend and has no gimmicks. By complying with these standards, you can be sure you're getting the ideal feasible deal on a fixed annuity.: Oceanview Annuity due to the fact that they often tend to have greater interest prices with common liquidity. ("A" rated annuity firm): Clear Spring Annuity due to the fact that they are straightforward, solid annuity rates and standard liquidity.

Nonetheless, some SPIAs use emergency situation liquidity includes that we such as. If you seek an instant earnings annuity, consider set index annuities with an assured lifetime revenue biker and start the revenue quickly. Annuity owners will have the flexibility to transform the retired life income on or off, gain access to their savings, and have the ability to stay on par with inflation and gain interest while getting the revenue for life.

There are a couple of crucial variables when looking for the ideal annuity. Compare interest prices. A greater interest rate will certainly use more development possibility for your financial investment.

This can promptly boost your investment, however it is essential to comprehend the terms attached to the bonus offer prior to spending. Assume regarding whether you want a life time earnings stream. This kind of annuity can give assurance in retirement, yet it is crucial to make certain that the earnings stream will be sufficient to cover your demands.

These annuities pay a fixed month-to-month quantity for as lengthy as you live. And even if the annuity runs out of money, the regular monthly repayments will continue coming from the insurance firm. That suggests you can rest simple recognizing you'll constantly have a stable revenue stream, no matter the length of time you live.

Sammons Livewell Variable Annuity

While there are several different kinds of annuities, the most effective annuity for long-lasting care prices is one that will pay for most, if not all, of the expenditures. There are a few points to take into consideration when picking an annuity, such as the length of the contract and the payout alternatives.

When selecting a fixed index annuity, compare the offered products to find one that best fits your requirements. Take pleasure in a lifetime income you and your spouse can not outlive, offering financial security throughout retirement.

Annuity Sample Problems

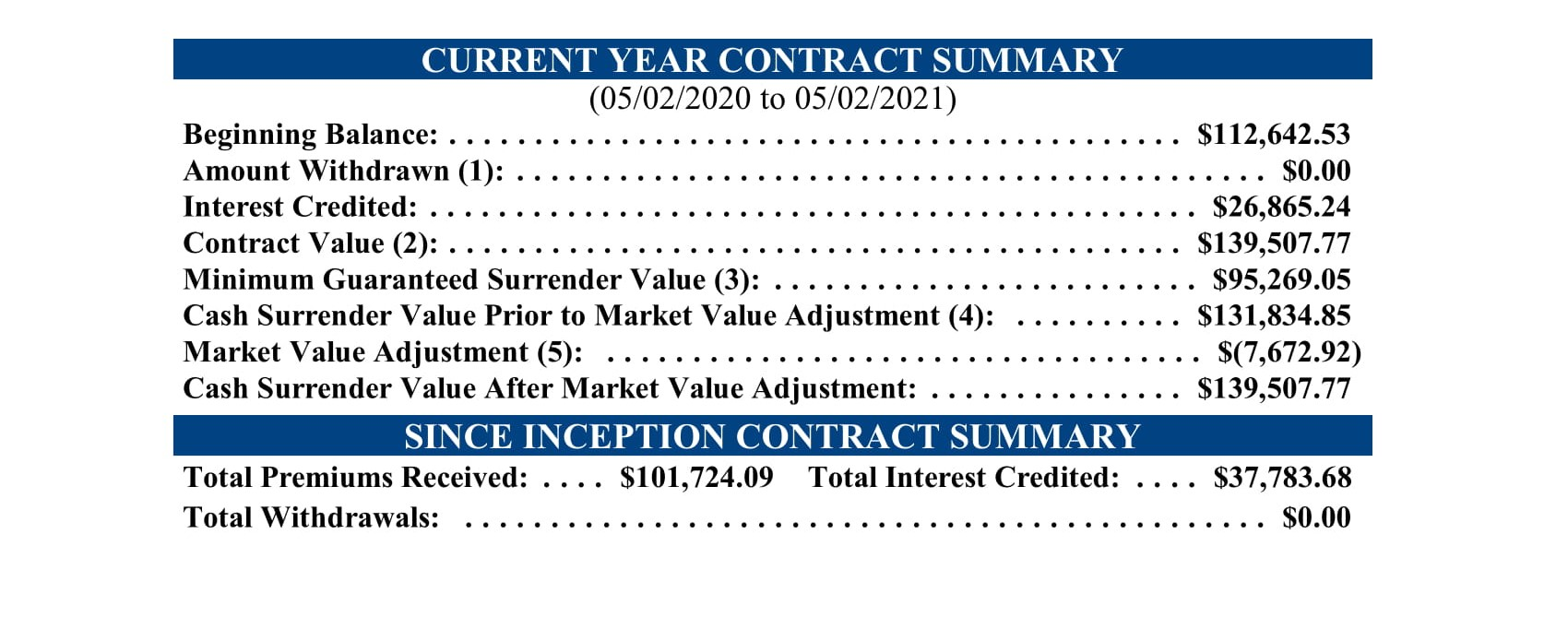

These annuities highlight the highest possible returns (hypothetically). The photo listed below is a bit from my annuity to give you a far better idea of returns. There are a couple of essential variables to think about when finding the best annuities for senior citizens. Based on these criteria, our suggestion for the would be American National. Additionally, they enable approximately 10% of your account worth to be taken out without a penalty on a lot of their item offerings, which is greater than what most other insurance coverage firms enable. One more element in our referral is that they will certainly enable seniors as much as and including age 85, which is likewise greater than what a few other firms permit.

The ideal annuity for retired life will certainly depend on your individual requirements and purposes. An appropriate annuity will give a constant stream of earnings that you can count on in retirement.

Local 472 Annuity

They are and consistently use some of the highest possible payouts on their retirement income annuities. While prices change throughout the year, Fidelity and Guarantee are generally near the leading and keep their retirement revenues competitive with the various other retirement earnings annuities in the market.

These ratings provide consumers a concept of an insurance provider's monetary stability and exactly how most likely it is to pay on claims. Nevertheless, it's important to keep in mind that these rankings do not necessarily show the high quality of the items offered by an insurer. As an example, an "A+"-rated insurer might use products with little to no development potential or a reduced income permanently.

Your retirement financial savings are likely to be one of the most important investments you will certainly ever before make. If the insurance policy business can not attain an A- or much better score, you should not "bet" on its capability lasting. Do you want to bet money on them?

Latest Posts

American National Insurance Company Annuity

Best Death Benefit Annuity

Athene Fixed Index Annuity Reviews